Perhaps it was inevitable that the yearly increase in the sale of battery electric vehicle and charging stations would eventually suffer a hic-up, market correction, down-turn, readjustment or whatever it is called. But that appears to be what the two sectors are wrestling with at the moment, according to speakers on the second day of the London Electric Vehicle Show.

That is not to say that sales are looking poor in the long term. In Europe especially, national government dictats about net zero emissions and European Union calls for decarbonisation ensure future growth of the two sectors. But, as Ferenc Kumin, Hungary’s ambassador to the UK said in his presentation, even a tiny negative or downward adjustment can greatly affect small to medium size suppliers to the sectors, as has happened in his country. This is partly because most of the Hungarian-made EVs and related products are exported to the rest of Europe.

The reasons for downturn as several and not unsurprising, said Fransua Vytautas Razvadauskas, insights manager for mobility with Euromonitor International. Affordability of EVs remains the biggest concern, even as Chinese manufacturers are able to undercut products from most other manufacturers, especially the legacy petrol and diesel vehicle makers. Second biggest concern, according to their survey, remains charging; will there be enough stations and will one be available when I get it. Also in the mix are concerns over the safety surrounding battery fires.

Nonetheless, this year it looks like the global sales of new electric light vehicles will be 19% of all light vehicles. This is up from around 14 million in 2023 to nearly 16 million by the end of this year.

China’s share of the global passenger car market this year will be close to 60%. As well, China’s share of global EV production and assemble will be 70%. China’s BYD remains by far the maker of the most EVs globally – 3.9 million units this year versus Tesla’s 2 million. But there is a noted trend, said Razvadauskas, toward fewer sales of purely electric vehicles (battery electric vehicles/BEVs) and more hybrid vehicles (HEVs, where the batteries are charged by regenerative braking and other methods) and plug-in hybrid electric vehicles (PHEVs) where the battery must be charged externally from the vehicle.

China’s share of the global passenger car market this year will be close to 60%. As well, China’s share of global EV production and assemble will be 70%. China’s BYD remains by far the maker of the most EVs globally – 3.9 million units this year versus Tesla’s 2 million. But there is a noted trend, said Razvadauskas, toward fewer sales of purely electric vehicles (battery electric vehicles/BEVs) and more hybrid vehicles (HEVs, where the batteries are charged by regenerative braking and other methods) and plug-in hybrid electric vehicles (PHEVs) where the battery must be charged externally from the vehicle.

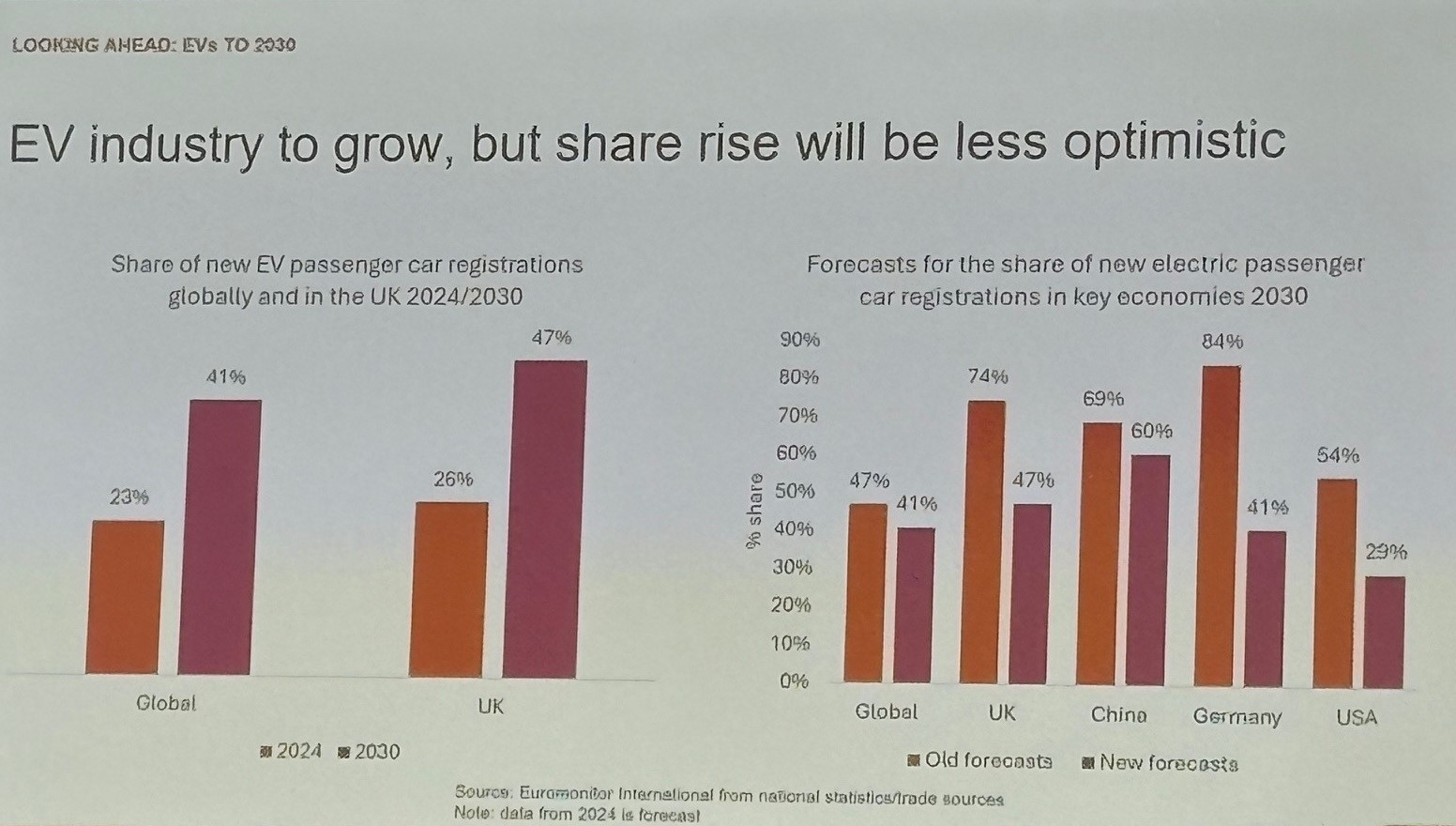

The forecasts for the share of new electric passenger car registrations in key economies to 2030 has been revised, noted Razvadauskas. Globally, the drop is only 6%. However, the market is markedly more subdued in the US, dropping from 54% down to 29%. Germany, too, where potential customers are looking much more jaded, with the forecast of registrations plummeting from 84% to 41%.

Meanwhile, government’s continue to push for more sales of EVs in the coming decade and have an abundance of policies to hopefully stimulate the vehicle market as well as the charging market. Practical tactics include, such as in Budapest, free inner city parking, said the country’s ambassador during a panel discussion.

Much more can be done to encourage home charging, said Louise Evans, policy executive at Energy UK, a trade association for the energy industry. Energy UK’s members deliver nearly 80% of the UK's power generation and over 95% of the energy supplied to UK homes and businesses. There should be innovative more ways to encourage EV owners to charge at times outside high drawdown times of the national grid. Also, there should be easier transfer of low-cost power in an EV back into the home-owner’s residence.

Greater allowance should be adopted for homeowners to use an e-gully for having their charging cables run from their terraced home across a pedestrian path to their car parked in front of the house.

Apart from physical issues about charging at home and at stations, there are mounting frustrations with the ability pay with a debit or credit cards, said Robin Loos, deputy head of energy, transport and sustainability at BEUC, European Consumer Organisation. In his presentation, he urged energy suppliers and charging companies to “make charging more simple”. There is a definite lack of transparency about charging prices, he said. Is it kilowatt per hour or per minute? Loos pointed to a recent survey where 60% of drivers said they had experienced issues with paying procedures and 83% said they would like more options to simply swipe their debit or credit card.

The placing of charging stations continues to be challenging for those local UK councils which are mostly rural. Matthew Ling, environment strategy programme manager with Suffolk County Council, near London, said they have to get a good balance between putting charging stations in areas where they will benefit the most people while also benefiting the local economy the most.

In these cases, said Shamala Gadgil, senior project and project manager with Coventry City Council, collaboration between the public and private sector is essential. Consultations help, she noted in a panel discussion on the subject.

Paul Gambrell, team leader – ZEV and energy integration with Oxfordshire County Council, said the decision about where to place a charging station should be seen not as a top-down dictat. It should be a bottom up decision where the people who will use the stations have some say in where the stations are located.

When all is said and done, it requires the right leadership, public and private, which has a vision of the future.