The Biden presidency pledged US$5bn in National Electric Vehicle Infrastructure (NEVI) Program funding as part of the Infrastructure Investment and Jobs Act (IIJA). The NEVI Program allows for up to 80% of eligible project costs to be reclaimed and to “provide funding to States to strategically deploy EV charging infrastructure and to establish an interconnected.”

There is now the question of whether the new regime will continue to distribute the remaining NEVI funding to EV charging infrastructure deployers and help meet the Biden-Harris administration target of having 500,000 chargers across the US by 2030. This month the US Joint Office of Energy and Transportation said the national network is well ahead of schedule to meet this goal with 200,000 public charging bays now available.

The Trump presidency is probably good news for Tesla founder and CEO Elon Musk who is a high-profile Trump supporter. The President-Elect has said he will reward Musk for his support and may even offer him a role in his administration.

Previously a critic of state support for EV rollouts, Trump said at an electoral rally in August: “I’m for electric cars, I have to be because Elon endorsed me very strongly.”

This transactional Trump way of doing politics could have incidental benefits for other EV and infrastructure deployers if he supports Musk’s EV operations.

Tesla is the biggest EV charging infrastructure deployer in the country with more than 2,700 Supercharger stations in North America as of November 2024. Most of these are in California, with other major deployments being in Texas, Florida, New York and Pennsylvania. Tesla shares increased by 14% on news of the Trump victory.

The Trump presidency is likely to increase tariffs on imports which is bad news for foreign EV manufacturers including Mercedes, BMW and Chinese automakers, but good news for their US counterparts such as Ford, GM, Stellantis - and Tesla.

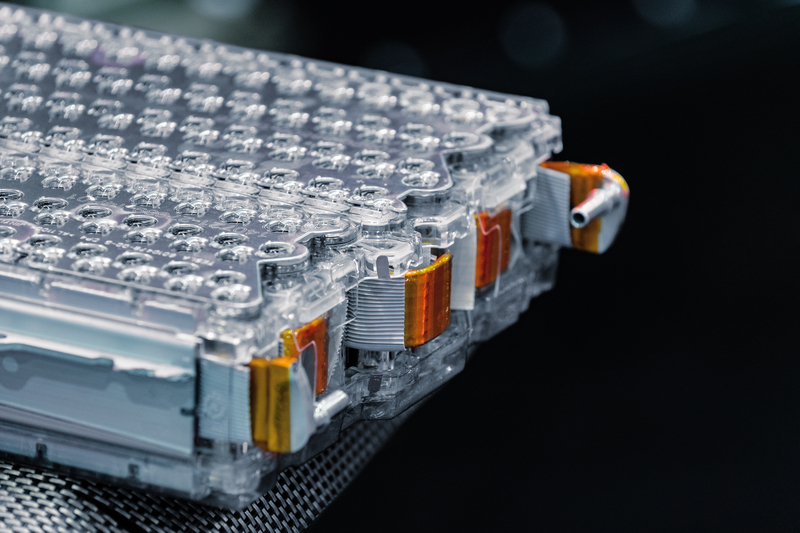

President Biden provided large loans for car manufacturers to build EV and battery plants in the US, in addition to tax credits for EV buyers.

Trump has said that he plans to cut EV subsidies and emissions standards, which could hit smaller EV companies but might give Tesla a competitive edge due to its established market presence.

In a note to investors, Wedbush analyst Dan Ives said: "Tesla has the scale and scope that is unmatched.

"This dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players."

The Zero Emission Transportation Association (ZETA) - a federal coalition focused on advocating for 100% EV sales whose members include EV infrastructure companies EVgo, EVBox and ChargePoint - said in a statement: "The electric vehicle industry stands ready to work with President-elect Donald Trump, Congressional Republicans, Democrats, Independents, and all groups that want to ensure our nation’s innovation and economic competitiveness remain the best in the world.

"The next four years are critical to ensuring that these technologies are developed and deployed by American workers in American factories for generations – a goal that unites every state regardless of their electoral college votes."

So the Trump victory is not necessarily a body blow for the EV and charging infrastructure sector, but it does cloud the picture and raises issues that will only be answered as the new presidency moves forward.