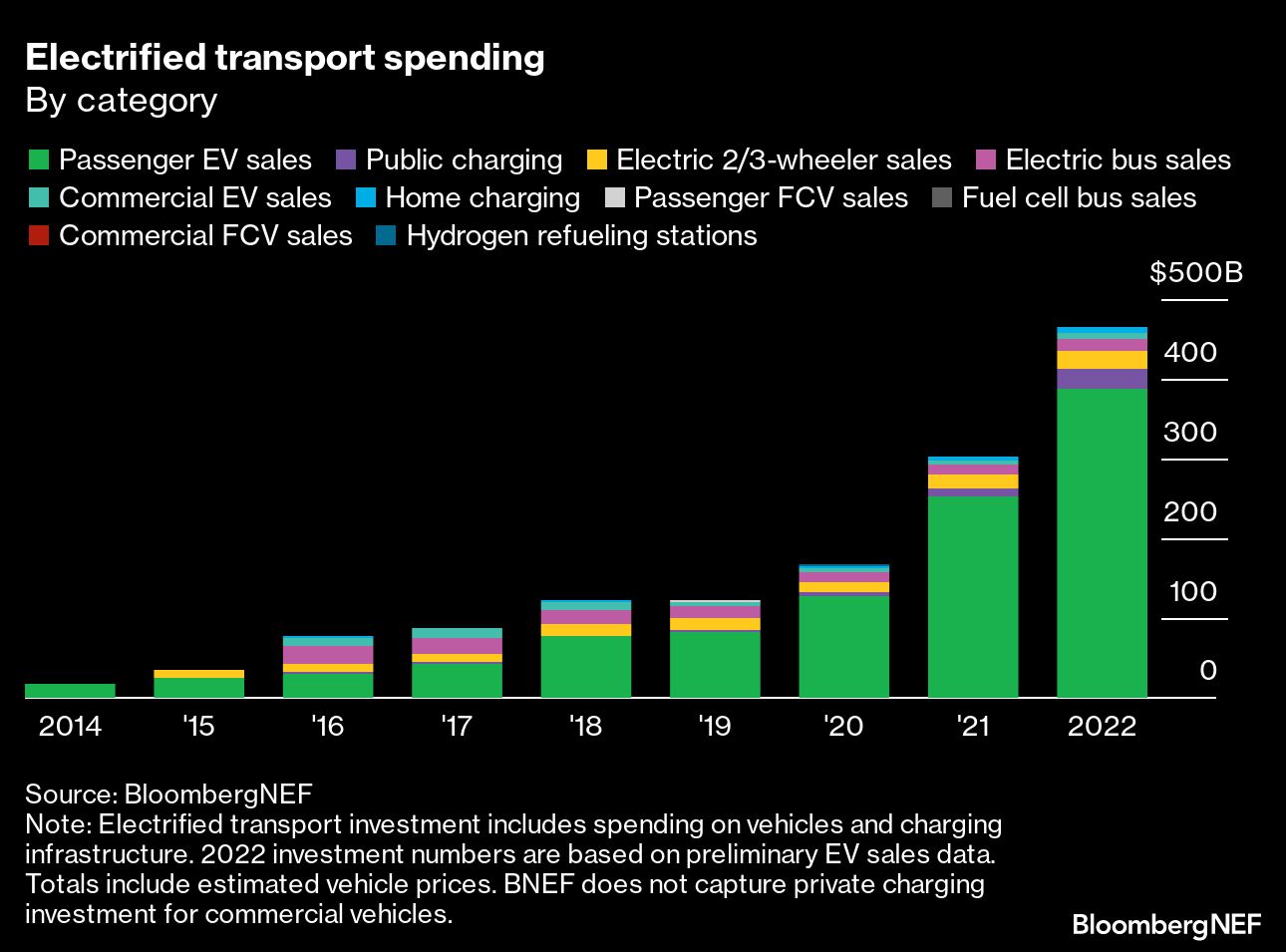

EV adoption has accelerated faster than predicted. Globally, EV sales doubled in 2021 and jumped 55% in 2022 to account for 13% of all vehicles sold. If this trend is to continue, however, the eMobility ecosystem must collaborate around 'Six essentials for mainstream EV adoption'. The study is informed by Eurelectric and its members and includes insights drawn from industry leaders across the ecosystem, including automotive, utilities, fleet management, city planning and charging infrastructure.

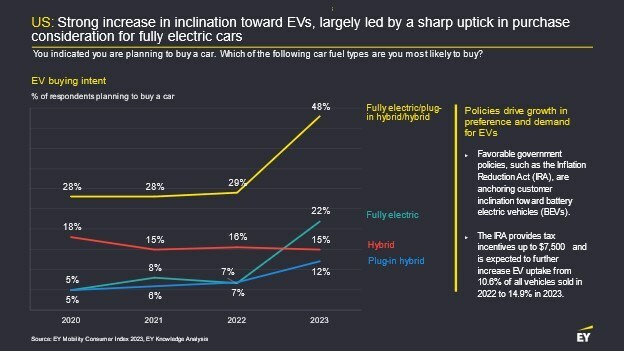

The study highlights that in 2022, EV sales in China reached 27% of total vehicles sold; in Europe, they made up just over 20%; and in the US, EV sales increased to more than 7% of all vehicles sold. But are conditions right for EVs to take off in the mass market? The study underscores the need for a collaborative and coordinated response from eMobility ecosystem players in pursuit of decarbonisation goals, with utilities, in particular, playing a pivotal role.

Serge Colle, EY global energy and resources industry market leader, says that despite economic headwinds and rising energy costs, EV sales are resilient and are continuing to accelerate. “Globally we have reached 13% adoption, but if EVs are to enter the mainstream, significant collaboration across the entire value chain is critical. The EY/Eurelectric study identifies six essentials that will make or break the future of eMobility. Failure to get this right could result in missed net-zero targets, unresolved air quality issues, wasted investments, and an extended eMobility transition period."

To avoid a modern-day cart-before-horse scenario, the six essentials include: resilient supply chains and vital raw materials; clean and green power production; accessible charging infrastructure; the integration of EVs with smart grid technology; digital platforms and mobile applications to optimise EV charging; and finding and training the next-generation workforce.

As the EV-buying demographic shifts from early adopters to a larger group of consumers with more mainstream values and expectations, accessible charging infrastructure for all is critical. The study calculates that by 2040, the total number of residential, private, and public chargers needed in Europe will top 140 million (88% will be destined for home charging) to service an estimated 239 million EVs. In the US, a total of 91 million chargers (85% for home charging) will be required to serve 152 million vehicles in the same timeframe.

To roll out charging infrastructure quickly and equitably, the study recommends incentivising, via regulation, installation in the spaces and places where people live and work. Cooperation between network operators and public authorities in preparing for network development, understanding the EV uptake, and assessing infrastructure needs and investments is also key.

Utilities come to the transition with electric-engineering acumen and deep knowledge of load on distribution and transmission lines. The study cites that in the transition to eMobility, they must take on a much more customer-facing and technology-dependent role. To be successful, utilities must engage proactively with city planners and continue building out networks that allow renewables, and other forms of distributed assets, to connect to the grid. Furthermore, they must manage new load at the point of charging and pursue new technologies that enable the two-way flow of energy across the system.