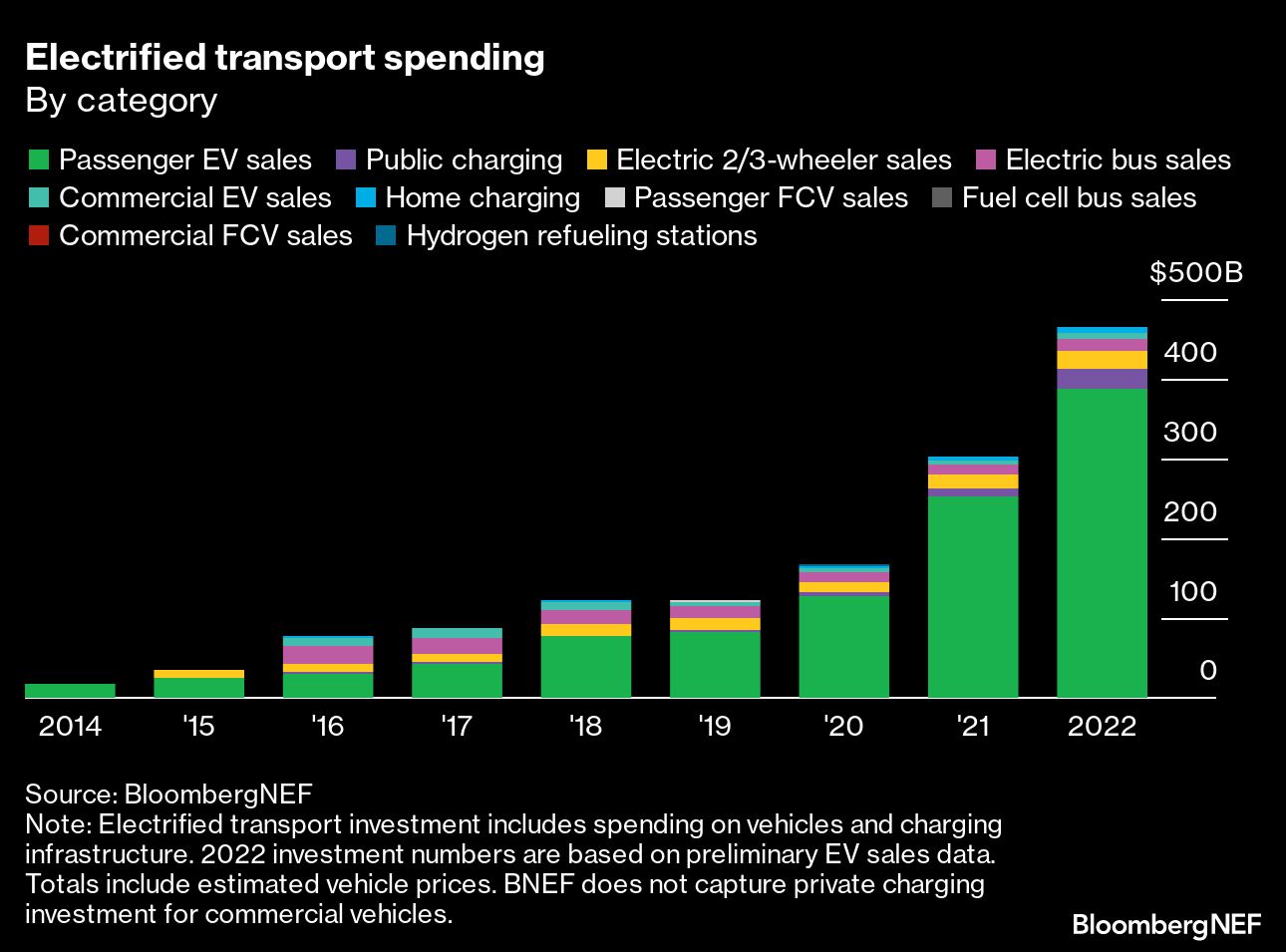

BNEF’s report tracks estimated EV spending across ten different categories, from sales of passenger EVs and fuel cell vehicles (FCVs) to public- and home-charging infrastructure. Global sales of passenger EVs surpassed 10 million in 2022, contributing US$388bn (or 83%) to the year’s total spending in electrified transport.

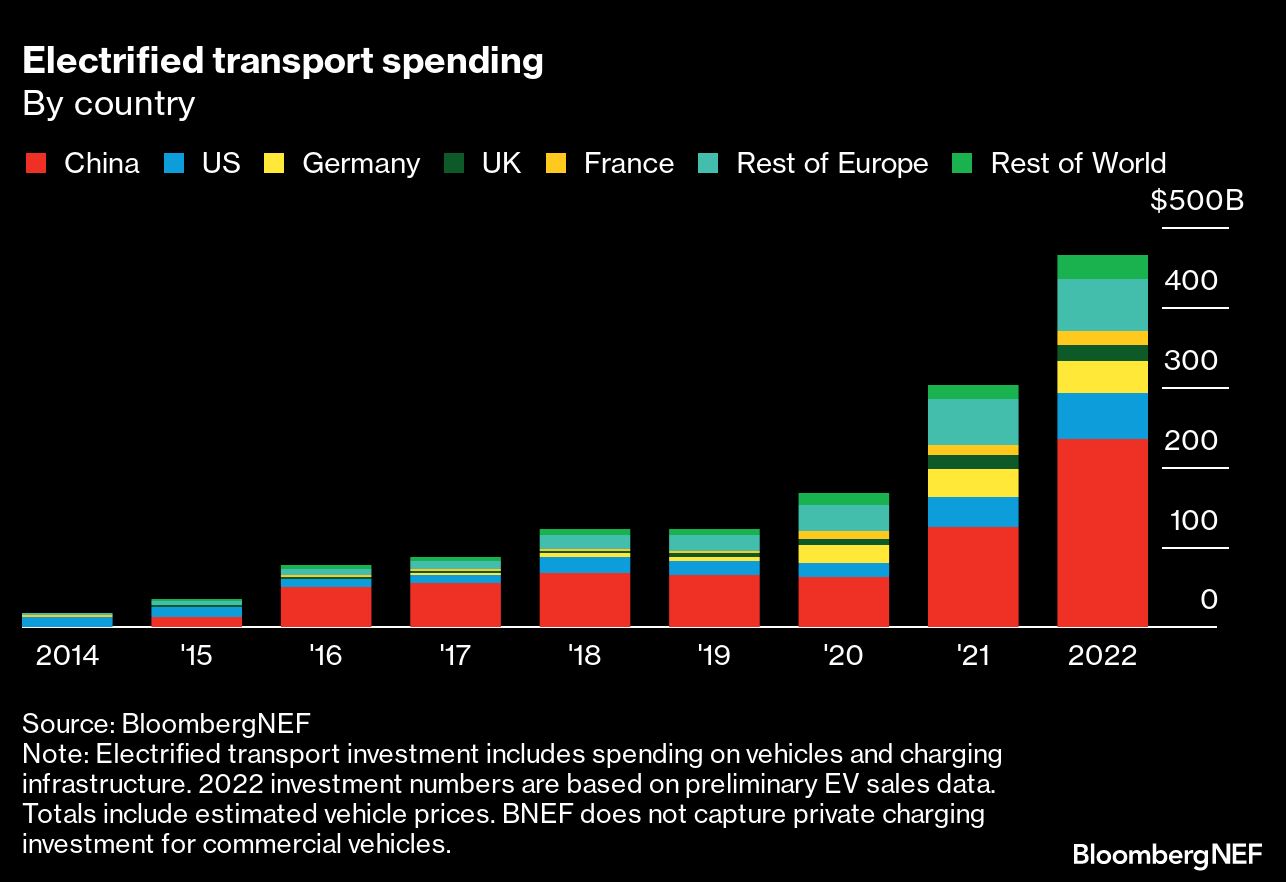

Electrified transport spending hit US$466bn in 2022, up 54% compared to 2021. Over half of that total (55%) took place in the APAC region, where China is leading the EV transition charge.

Of the total US$1.1 trillion invested in the global energy transition in 2022, electrified transport contributed a remarkable 42%, coming in just behind the US$495bn invested globally in renewable energy.

Public charging received US$24bn in investments in 2022, marking the second-largest chunk of cash invested in the sector last year. While charging came in a distant second place after passenger EVs, its success relative to other categories highlights the growing demand for public-charging infrastructure as more and more EVs take to the roads.

Charging infrastructure narrowly pipped the third-place category, electric two- and three-wheelers, which brought in US$23bn. This hefty sum is thanks in large part to the speedy EV transition taking place in the APAC region, where hundreds of millions of electric two-and three wheelers deployed in recent years.

Commercial EVs and electric bus sales together represented another US$23bn. Transport-related hydrogen spending – including commercial FCV sales, fuel cell bus sales, passenger FCV sales and hydrogen refueling stations – remained minuscule in comparison, at an estimated US$2bn.

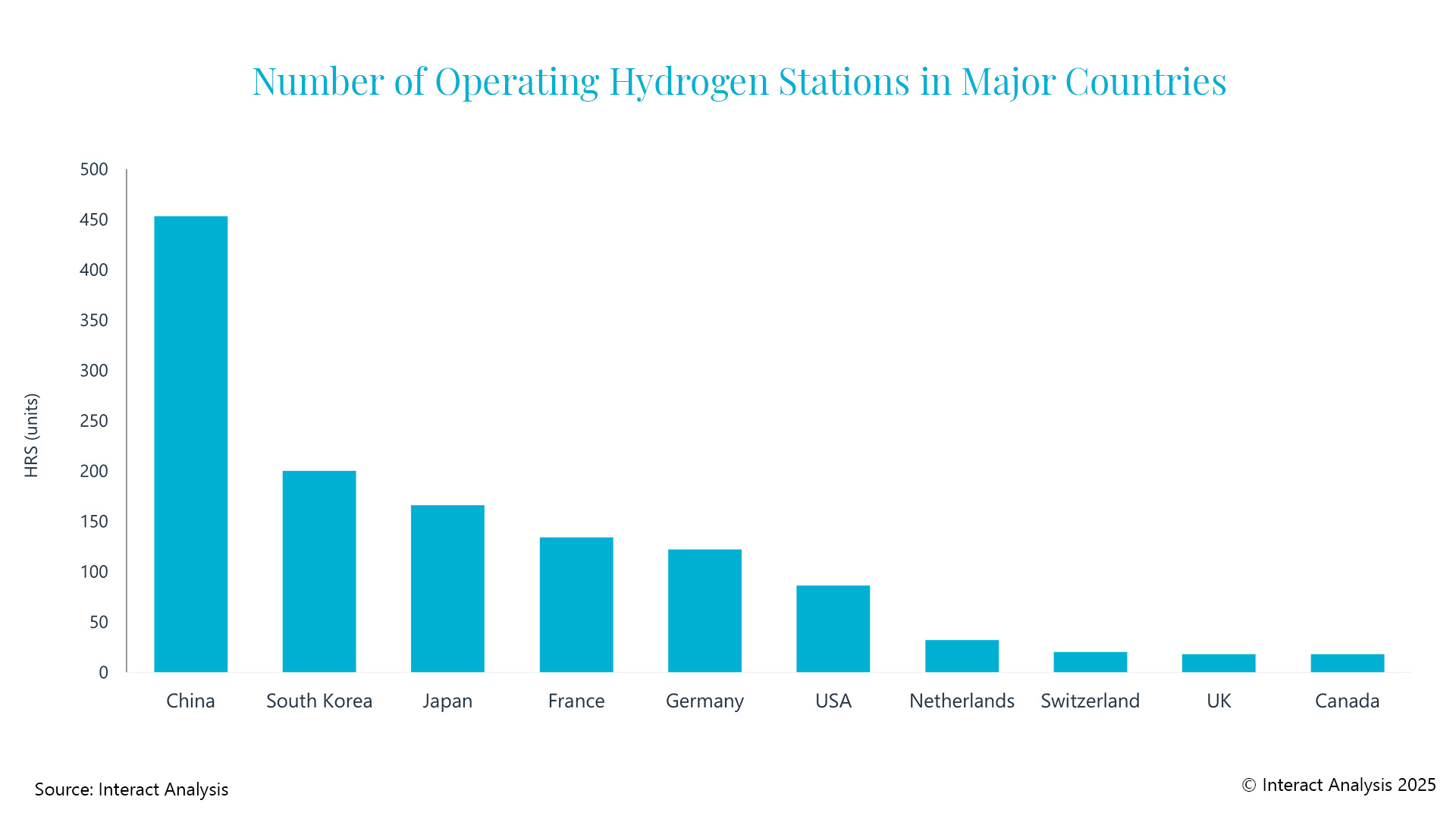

China remains the leader in the global EV transition. The country saw a remarkable US$234bn invested in electrified transport in 2022 – an 87% jump compared to the previous year, driven by continued growth across many of the segments that the report tracks. Over 6 million passenger EVs were sold in China in 2022, as well as thousands of new clean buses and commercial vehicles.

China is also one of the largest markets for electric two- and three-wheelers and a global leader in public-charging infrastructure deployment, with a cumulative network of just under 1.8 million public charging connectors available at the end of 2022.

The second biggest contributor to EV investment in 2022 was the US, where total electrified-transport spending hit US$57bn, up 57% compared to 2021. EV adoption in the US is accelerating following the recent passage of the Inflation Reduction Act, and the country is one to watch closely in 2023.

Other significant markets in 2022 included Germany, France, and the UK, despite a marked slowdown from the record growth rates of 2020 and 2021.