If anything, it is falling further behind. The recent move to open Tesla Superchargers to non-Tesla owners could improve the situation, but might not be the answer that some suggest, as overall satisfaction continues to decline. That’s according to the JD Power 2023 US Electric Vehicle Experience (EVX) Public Charging Study.

Despite the increase in public charging stations across the United States, customer satisfaction with public Level 2 charging has declined to 617 (on a 1,000-point scale), 16 points lower than a year ago and the lowest level since the study began in 2021. Though purported to be the wave of the future, satisfaction with DC (direct current) fast chargers has declined even further, dropping 20 points to 654. More troubling is that satisfaction in both charging station segments has declined in nearly every attribute measured in the study. Since consumer scepticism regarding public charging availability is the primary reason vehicle shoppers reject EVs, this performance could prove to be a further hindrance to EV acceptance.

"The declining customer satisfaction scores for public charging should be concerning to automakers and, more broadly, to public charging stakeholders," said Brent Gruber, executive director of the EV practice at JD Power. "The availability of public charging stations is still a critical obstacle, but it isn't the only one. EV owners continue to have issues with many aspects of public charging, as the cost and speed of charging and the availability of things to do while waiting for their vehicle to charge are the least satisfying aspects. At the same time, the reliability of public chargers continues to be a problem. The situation is stuck at a level where one of every five visits ends without charging, the majority of which are due to station outages."

Tesla owners are relatively satisfied with the Tesla Supercharger network (745), but when they go outside the network to use other public charging options, satisfaction declines by nearly 200 points (550). “With greater adoption of the North American Charging Standard (NACS) pioneered by Tesla, it may provide a boost in fast-charging satisfaction among owners of EVs from other brands as they begin to use Tesla’s Supercharger stations,” Gruber said. “We’re monitoring whether the use of Tesla Superchargers by non-Tesla owners will affect satisfaction, but the move does help address charger scarcity and offer access to industry-leading reliable chargers. It’s just too early to tell if it can reach the satisfaction levels of Tesla owners who are already part of that fully integrated Tesla ecosystem.”

Tesla owners are relatively satisfied with the Tesla Supercharger network (745), but when they go outside the network to use other public charging options, satisfaction declines by nearly 200 points (550). “With greater adoption of the North American Charging Standard (NACS) pioneered by Tesla, it may provide a boost in fast-charging satisfaction among owners of EVs from other brands as they begin to use Tesla’s Supercharger stations,” Gruber said. “We’re monitoring whether the use of Tesla Superchargers by non-Tesla owners will affect satisfaction, but the move does help address charger scarcity and offer access to industry-leading reliable chargers. It’s just too early to tell if it can reach the satisfaction levels of Tesla owners who are already part of that fully integrated Tesla ecosystem.”

Key findings of the 2023 study reveal that satisfaction with charging speeds has declined. EV owners are increasingly dissatisfied with the amount of time it takes to charge their vehicles. The attribute for speed of charging has the most significant negative effect on overall Level 2 satisfaction, decreasing 36 points year over year to 455. Interestingly, those using DC fast chargers don’t fare much better as satisfaction with the speed of charging declines 30 points to 588.

The study also revealed that public chargers need to be placed in appropriate locations. The reasons EV owners cite for choosing a Level 2 or a DC fast charger and the time they spend at the charger clearly indicate that public chargers should be located where they will most effectively serve their customers. Convenience is desired by both Level 2 and DC fast charger users, but DC fast charger users indicate a planned road trip is also a key reason for selection. DC fast charger users spend approximately 30 minutes charging their vehicle, preferring to get back on the road as soon as possible. “The data suggests that DC chargers — which charge faster — should be located along travel routes, while Level 2 chargers — essentially used for convenience charging — should be easily accessible near places where EV owners may already be visiting such as retail venues and entertainment venues,” Gruber said.

Non-charge visits remain an issue, and results differ by geographic location. The study finds that 20% of all users say they visited a charger but did not charge their vehicle. Reasons range from the charger being inoperable to long lines to use the charger. EV owners in the Miami-Port St. Lucie-Ft. Lauderdale Combined Statistical Area (CSA) had the worst experience in this regard, with 35% of visits failing to result in charging. The CSAs in Seattle-Tacoma, Denver-Aurora and Dallas-Ft. Worth each had 29% of visits failing to result in a charge. The Cleveland-Akron-Canton CSA had the lowest percentage of failed visits with a charging failure rate of 12%.

"The results of this year's study should be very concerning to all those involved in the transition from gas-powered vehicles to electric vehicles," Gruber said. “Although the majority of EV charging occurs at home, public charging needs to provide a much better experience across the board — not just for the users of today, but also to alleviate the concerns of sceptical future customers. A lot of work is underway to address these issues but there is certainly much more work to be done.”

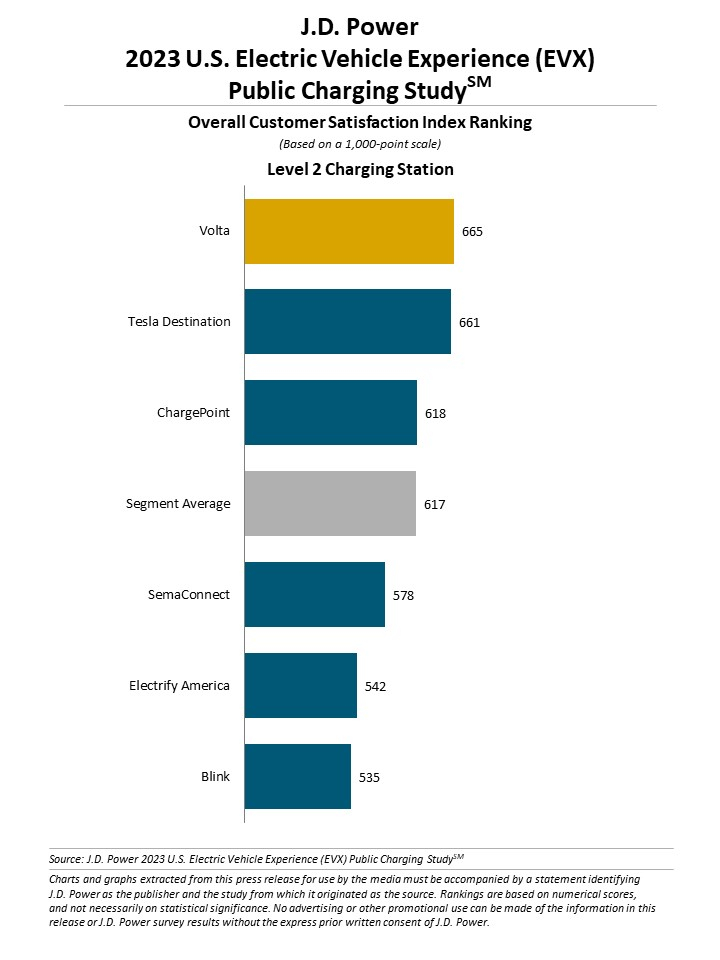

Volta ranks highest among Level 2 charging stations, with a score of 665. Tesla Destination (661) ranks second and ChargePoint (618) ranks third.

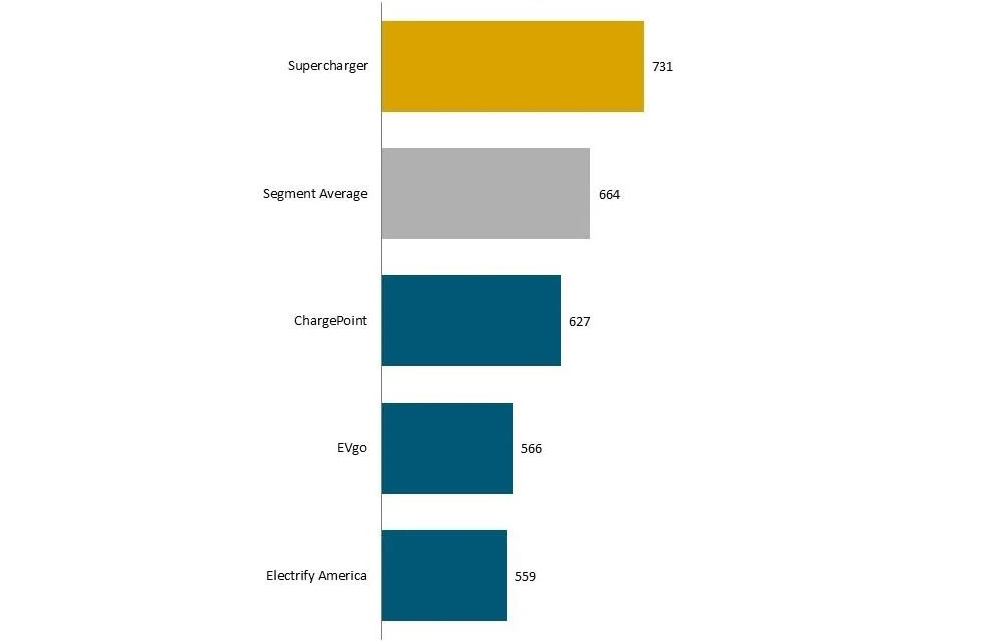

Tesla Supercharger ranks highest among DC fast chargers for a third consecutive year, with a score of 739. It is the only DC fast charger brand to rank above segment average.

The study, now in its third year, measures EV owners’ satisfaction with two types of public charge point operators: Level 2 charging stations and DC fast charger stations. Satisfaction is measured across 10 factors (in order of importance): ease of charging; speed of charging; physical condition of charging station; availability of chargers; convenience of this location; things to do while charging; how safe you feel at this location; ease of finding this location; cost of charging; and ease of payment.

The 2023 US Electric Vehicle Experience (EVX) Public Charging Study is driven by a collaboration with PlugShare, the leading EV driver app maker and research firm. The study examines consumer attitudes, behaviours and satisfaction, setting the standard for benchmarking the overall experience of public EV charging. Respondents included 15,079 owners of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). The study was fielded from January through June 2023.

For more information about the US Electric Vehicle Experience (EVX) Public Charging Study, visit https://www.jdpower.com/business/automotive/electric-vehicle-experience-evx-public-charging-study.