ABL is a provider of EV charging solutions based in Germany, the largest EV market in Europe with more than two million EVs on the road. Combined, Wallbox and ABL have over one million EV chargers installed worldwide.

With decades of experience in the energy management and e-mobility industries, ABL brings with it innovative products, valuable customer relationships, a respected and experienced management team, and proprietary calibration technologies that will accelerate Wallbox’s ability to meet new market requirements. ABL’s focus on smart charging for commercial and residential applications has positioned the company as a leader in the segment. Wallbox is acquiring ABL’s state-of-the-art manufacturing and assembly facility in Germany and its component manufacturing facility in Morocco.

This transaction meets several critical strategic criteria for Wallbox, which will quickly begin to deliver value to customers, partners, and shareholders.

First, this transaction accelerates Wallbox’s commercial business plan by enhancing the product and certification portfolio, including German EV charging calibration law (Eichrecht). Leveraging ABLs relationships, reputation, and experienced team, Wallbox can now deliver a comprehensive suite of residential, commercial, and public charging hardware and energy management software in this attractive market.

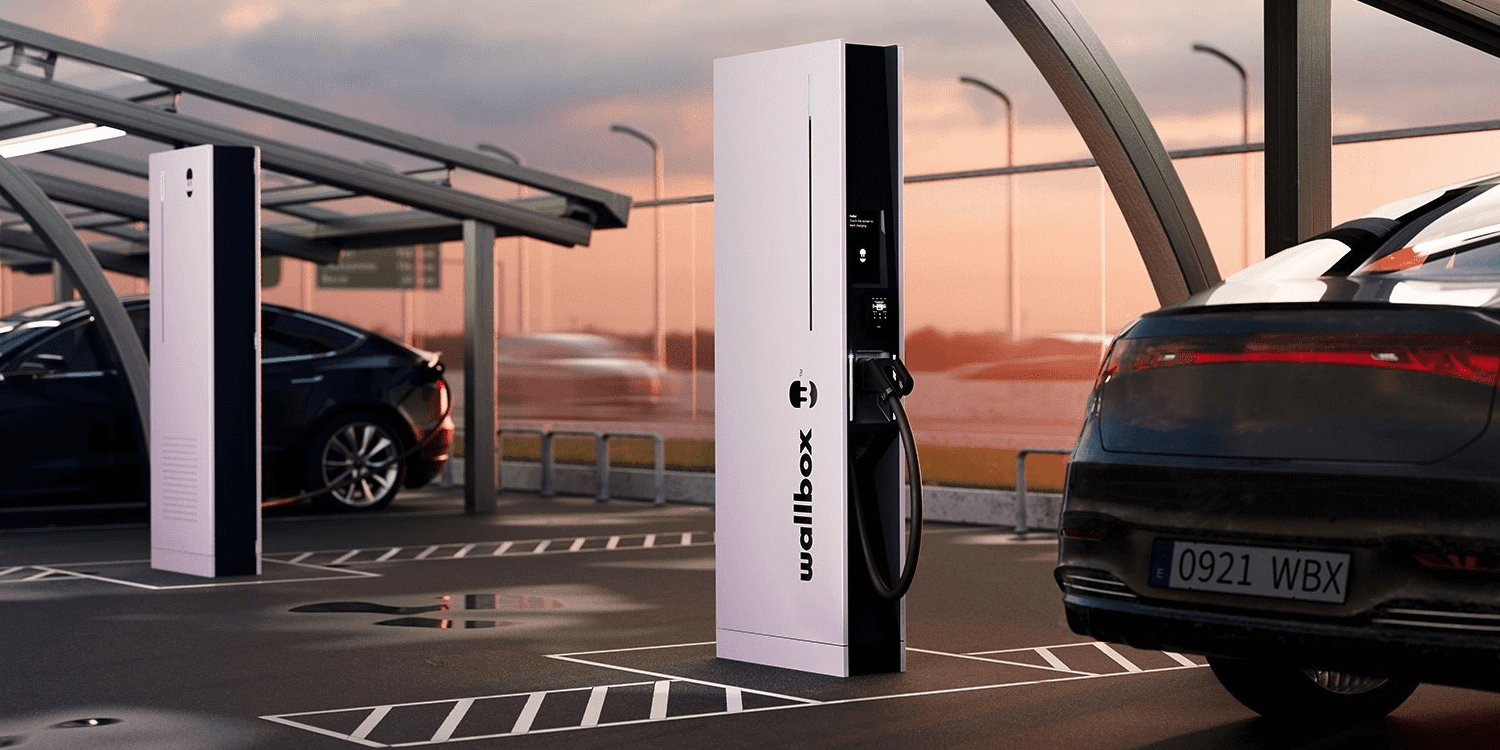

Second, Wallbox will benefit from reduced operational risk through reduced Capex and R&D spend, plus leveraging ABL’s in-house component manufacturing. These combined efforts will enable Wallbox to bring new products to market more quickly and efficiently, including Supernova and Hypernova DC fast chargers.

Most importantly, this transaction enhances the scale and financial performance of Wallbox by immediately adding substantial sales and improving future earnings as Wallbox utilises ABL’s existing technology and highly efficient workforce.

The transaction is subject to approval by process administration, but is not subject to regulatory approvals. It is expected to close within the 4th quarter, 2023. Additional transaction and company details will be shared on Wallbox’s Q3 2023 earnings call scheduled on 9 November, 2023 at 8:00am ET.