A new report from Persistence Market Research states that, as sustainability concerns and stringent emission regulations push industries toward electrification, the demand for robust charging infrastructure is increasing.

Persistence Market Research says that the market was valued at approximately US$6.6bn in 2024 and is expected to reach US1$6.1bn by 2031, growing at a CAGR of 13.6%. This surge is driven by the widespread adoption of electric buses, trucks, forklifts, and construction equipment, coupled with advancements in high-power charging technologies.

"The demand for high-capacity charging stations capable of supporting large battery systems is rising as industries seek efficient and reliable energy solutions," the report states. "Additionally, government initiatives promoting clean energy adoption further fuel market expansion."

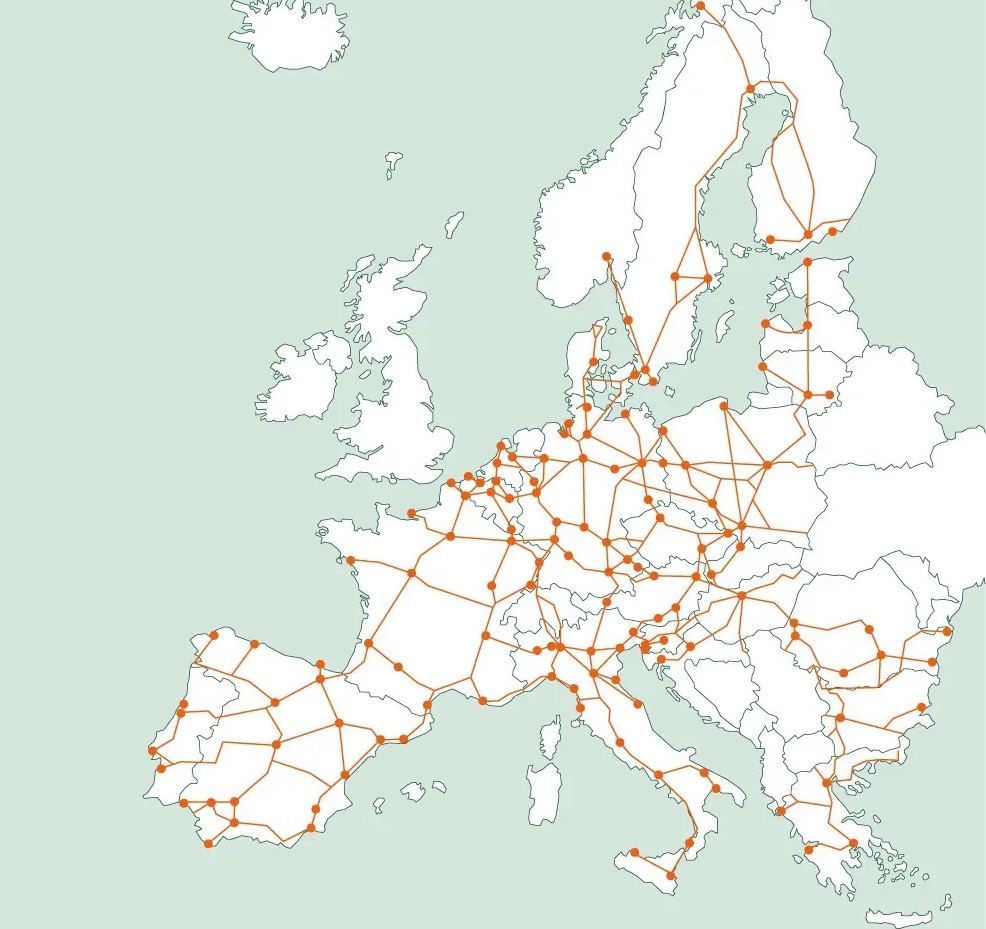

Governments worldwide are enforcing stricter emission regulations, pushing industries to transition from diesel-powered vehicles and machinery to electric alternatives. This shift is fueling demand for fast, high-power charging solutions tailored for heavy EVs and industrial fleets.

The development of ultra-fast DC chargers, wireless charging systems, and battery-swapping technologies is accelerating market growth. Innovations such as megawatt charging systems (MCS) are addressing the specific needs of heavy-duty electric vehicles, reducing charging time and enhancing operational efficiency.

Many governments are offering subsidies and incentives for the deployment of EV charging infrastructure. Large-scale investments in smart grids, renewable energy integration, and EV-friendly policies are creating a conducive environment for market expansion.

Growing Demand for Sustainable Industrial Solutions

Industries such as mining, logistics, and construction are increasingly adopting electric equipment to reduce carbon footprints and comply with environmental regulations. This trend is driving investments in dedicated industrial charging solutions, ensuring seamless operation of electric machinery.

Challenges in the Market include high initial investment costs. Setting up heavy EV charging infrastructure requires substantial investment in land, power supply, and high-capacity chargers. The cost of installation and grid upgrades can be a barrier to adoption, particularly for smaller businesses.

The integration of high-power chargers can strain existing electrical grids, necessitating upgrades and intelligent load management systems. The challenge lies in balancing energy demand without causing disruptions or power shortages.

The absence of universal charging standards for heavy EVs and industrial equipment creates compatibility issues. Industry players are working toward standardization, but variations in plug types, voltage requirements, and charging protocols remain a concern.

The report says that megawatt charging technology (MCS) is emerging as a game-changer, enabling electric trucks and industrial vehicles to recharge rapidly. High-voltage DC fast chargers with power outputs exceeding 350 kW are being deployed to meet the growing demand for quick turnaround times in industrial operations.

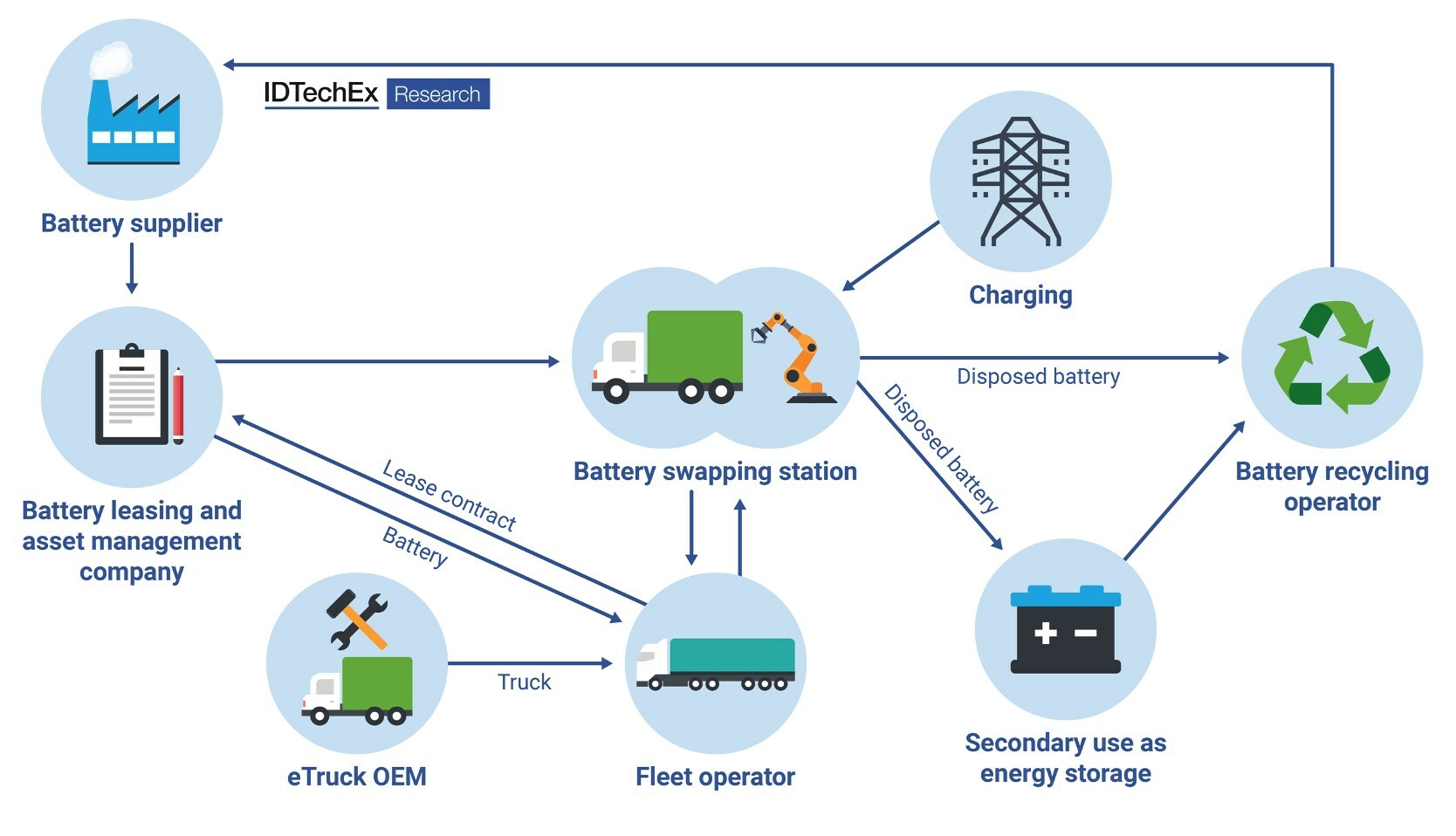

Battery-swapping technology is gaining traction, particularly in the logistics and material handling sectors. Swappable battery packs eliminate downtime associated with charging, ensuring continuous operation of electric forklifts, cranes, and other industrial vehicles.

To enhance sustainability, companies are integrating solar and wind power into charging stations. Hybrid renewable energy-based charging solutions help reduce dependence on fossil fuels and lower operational costs.

The adoption of AI-driven smart charging systems is on the rise. These solutions optimize charging schedules based on energy demand, grid availability, and cost efficiency. Dynamic load balancing and vehicle-to-grid (V2G) technology further enhance grid stability and energy utilization.