Decarbonization goals and regulatory support may have been the initial driver of the electrification of heavy-duty fleets, but operators are quickly discovering the lifetime cost advantages of a fully electric fleet.

With nearly 100,000 eTrucks forecast to be sold this year, the market is quickly growing, and the charging infrastructure must grow in tandem. Global technology intelligence firm ABI Research forecasts this growth to lead to a rapid climb in charging revenues for this vehicle segment, growing at a 29% CAGR to nearly USD$21 billion by 2035. To capture this potential, stakeholders in the market will have to tackle the chicken-and-egg problem that it inherited from passenger EVs, as well as the critical grid capacity challenge.

"The chicken-and-egg problem refers to the uptake of the electric vehicles being dependent on the presence of supporting charging infrastructure, but the installing of said infrastructure relies on the presence of an installed base of electric vehicles which will use it and pay off the investment," saysAbu Miah, electric vehicles analyst at ABI Research. "Private companies are leading heavy-duty EV support with their own charging depots, while public subsidies install enroute chargers for longer journeys. Fleet electrification is increasingly seen as a cost-cutting measure as infrastructure grows, accelerating further development with increased electrification."

While Western European countries and notably China are significantly ahead of North America in developing this infrastructure, there are also notable advancements within the US. Particularly, stakeholders in the U.S. are making progress in establishing charging infrastructure along freight corridors and logistics hubs. For instance, projects like the Greenlane Corridor (led by Daimler, Volvo, and Navistar), the Maersk-Prologis Partnership, and Voltera with its 22 commercial EV depots highlight this trend. The lack of strong adoption of eTrucks in the U.S. is driven by a combination of factors, from uncertainty around the new administration's attitudes toward commercial EVs, to lack of enthusiasm from fleet operators and other stakeholders to electrify their heavy-duty vehicles.

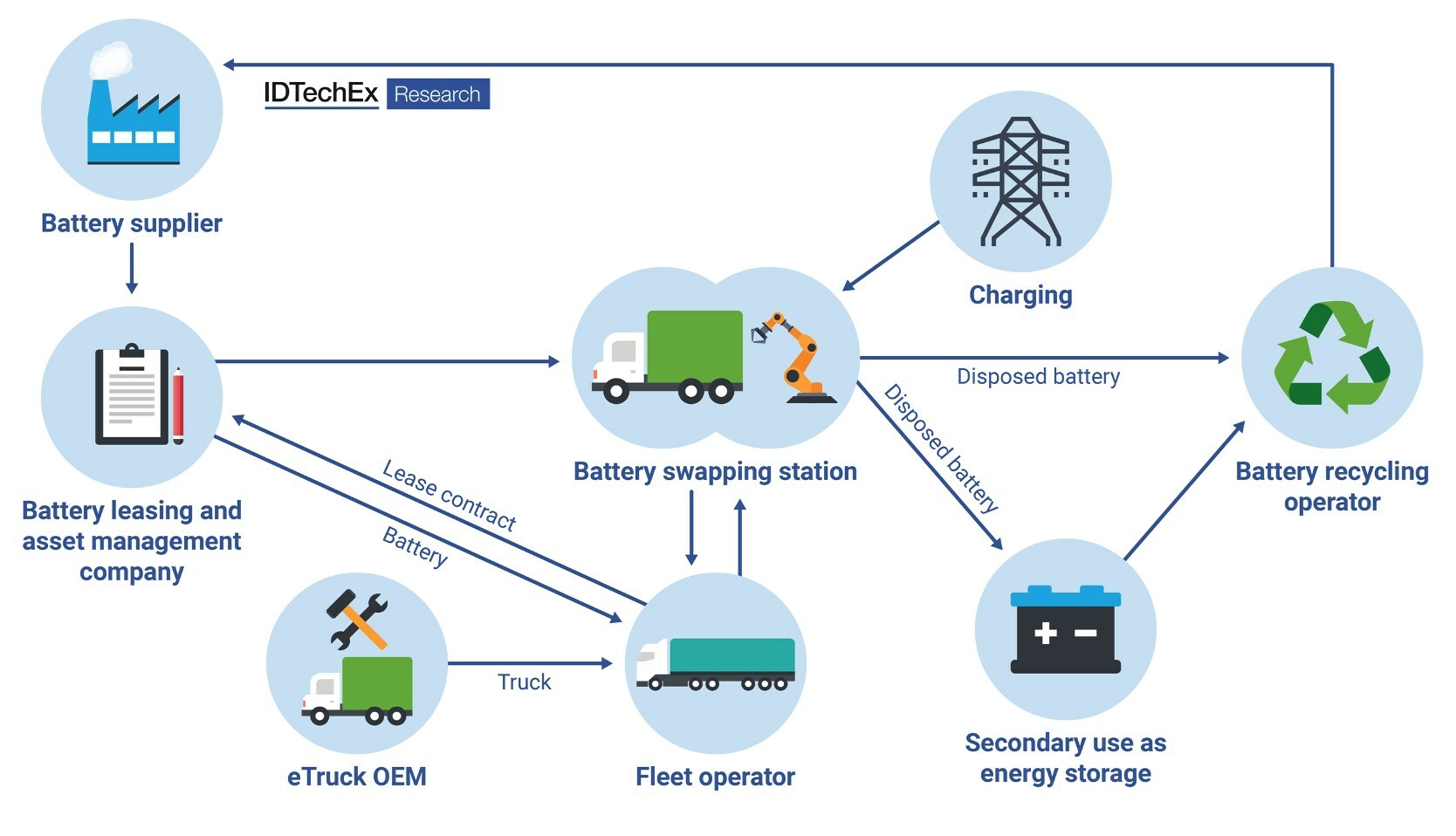

As the industry matures, and Megawatt Charging System (MCS) chargers enter the ecosystem, the strain on the grid will only rise, with energy demand from charging expected to reach 23TWh by 2030. "Lead times for sites and even rejections to charging depot sites will rise, and stakeholders will have to find another way to continue electrification of the heavy-duty fleet. On-site generation, battery energy storage systems, battery swapping, or bi-directional charging have all been posited as potential solutions but are either negligible in their impact or too nascent in the technology to be implemented. Ensuring, and capturing, growth in the industry depends on the combined efforts of public and private stakeholders to streamline the charging experience and upgrade the grid to sustain a growing electric fleet," Miah concludes.