IDTechEx also predicts that the cumulative global investment in global charging infrastructure will exceed US$123 billion by 2034 (hardware cost alone). The company research aims to keep up with the changes and developments in EV charging by monitoring and analysing the EV charging industry, its developments and regulations, and the latest technological trends and innovations.

There is undoubtedly a huge push to build global DC fast-charging networks. The US government is providing more than US$5 billion in funding and incentives as part of the NEVI program to build a coast-to-coast fast charging network, and many countries in Europe are rolling out similar programs following the AFIR regulations to spur EV charging infrastructure growth. 2024 will be a big year for EV charging, but, as discussed in this article, there's more to the story. IDTechEx's report "Charging Infrastructure for Electric Vehicles and Fleets 2024-2034" covers the trends and developments in the EV charging industry.

EV charging solutions are diversifying

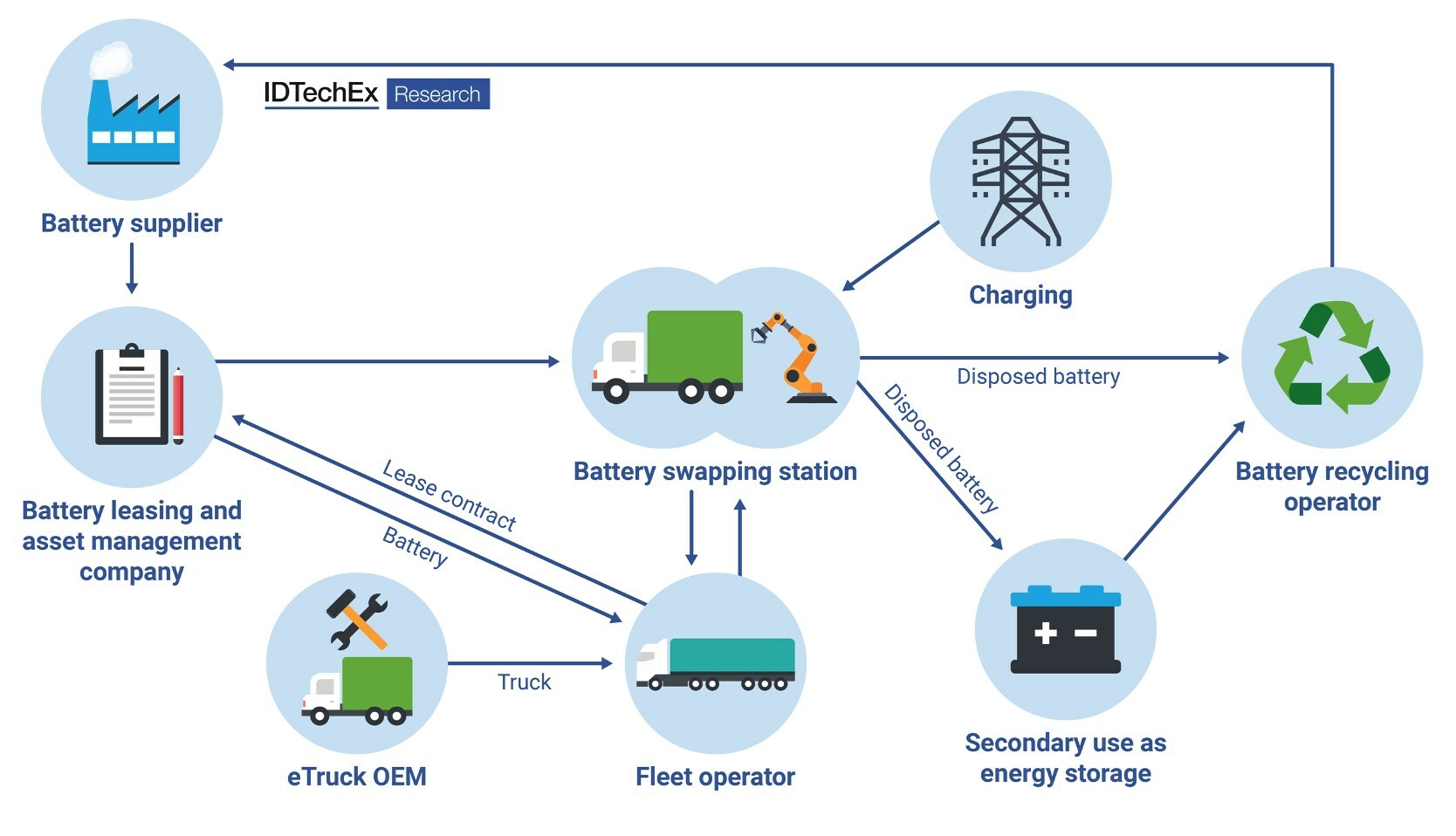

As electrification penetrates multiple vehicle markets, the type of charging infrastructure needed is also evolving. The IDTechEx charging infrastructure market report provides an in-depth coverage of multiple types of EV charging solutions including private AC charging, public DC charging, megawatt charging, battery swapping, and wireless charging. Vehicle platform voltages are shifting from 400 to 800 V architectures with the use of traction integrated on-board DC charging, unlocking even higher charging powers, while bringing new thermal challenges. This research provides clarity on the different technologies available today and those emerging with potential for disruption in the future.

Technologies like destination or wallbox DC chargers, megawatt charging, robotic charging, battery-buffered charging, off-grid charging, and mobile charging are some examples of the emerging EV charging solutions included in the research. The EV charging market report covers the key players within these fields, benchmarks their products, and provides a market outlook for their adoption.

MCS has the spotlight and large promises to fulfil

The major constraint to rapid commercial adoption of electric trucks in regional and long-haul operations is the availability of high-power opportunity charging along highways. The Megawatt Charging System (MCS) promises to deliver 1 MW power levels to quickly top-up batteries in mandated break times for truck drivers, although no commercial installations have been made ready to use yet. The Traton, Volvo, and Daimler established joint venture, Milence, has four sites in operation all using CCS chargers rated for 400 kW power output with future plans to install MCS. IDTechEx speculates that visibility around spare grid capacity and connection timelines (and faster processing) are current challenges in industry.

Ensuring high utilisation will also be key to ensure the economic viability of MCS. As such, at an early stage of the electric truck market, charge point operators (CPOs) will find it hard to justify the business case for MCS. CCS can cover a significant share of heavy-duty vehicle (HDV) charging needs in locations where MCS does not make economic sense i.e. areas where there is low density of truck traffic. IDTechEx reports that the absence of MCS should not be a major barrier to electrification of trucks.

The Alternative Fuel Infrastructure Regulation (AFIR) was designed to provide base coverage along European Highways starting in 2025. According to IDTechEx, countries that see most HDV traffic will need to over comply with AFIR targets. Countries like Germany, France, and Poland will need more public charging to cater to a larger operational eTruck fleet. For countries like Sweden where the traffic density is lower, the average power needed per site will also be lower.

Are off-grid charging solutions the stepping stone before the grid catches up?

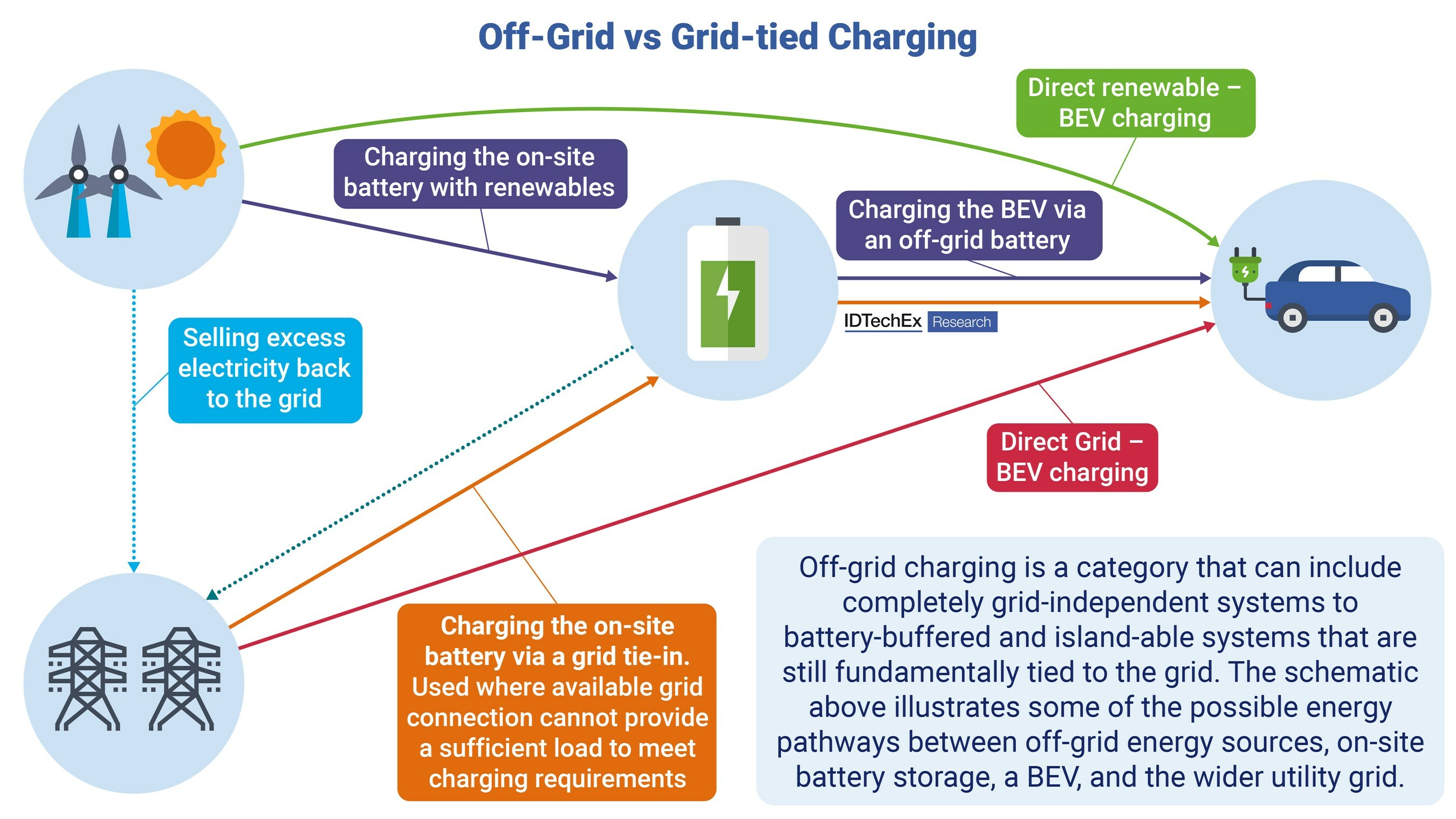

As BEV uptake increases, utility grids are becoming increasingly strained, leading to growing concerns about the capacity of distribution networks being able to support the necessary roll-out of EV charging infrastructure. Additionally, the expansion of electrification in new sectors such as construction presents unique challenges and opportunities in charging requirements. To address these issues, grid-independent charging systems are being developed and deployed, and IDTechEx's research contains extensive coverage and analysis of off-grid charging technology and players in the recent report "Off-Grid Charging For Electric Vehicles 2024-2034: Technologies, Benchmarking, Players and Forecasts".

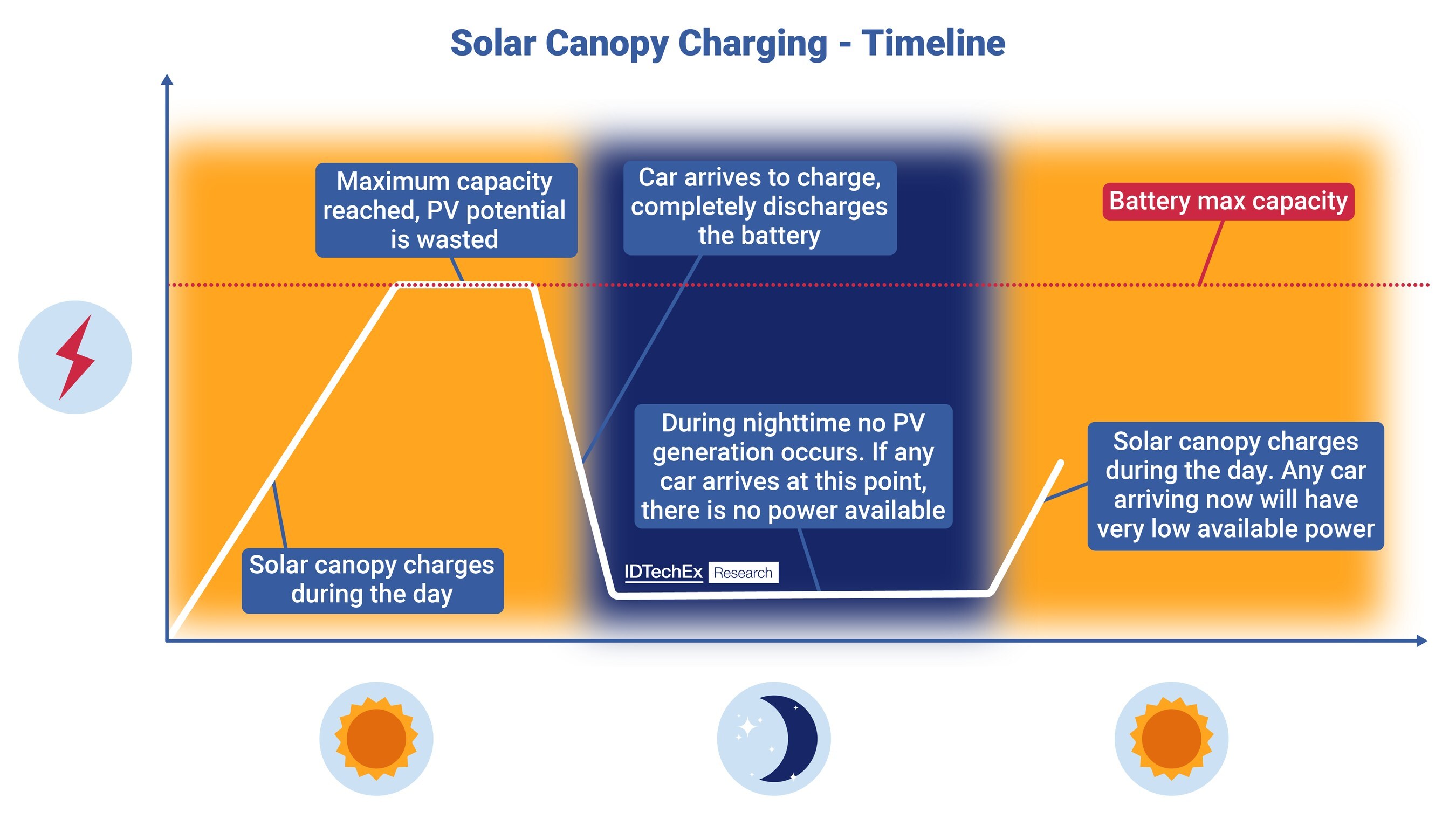

A wide range of fully off-grid and hybrid solutions are emerging to the market, powered by a range of energy sources. Solar canopy chargers are currently the most mature market and offer 100% renewable electricity without any infrastructure required. Hydrogen fuel cell technology is increasingly prevalent in distributed generation and is seen by many advocates as a green alternative to polluting and carbon-intensive diesel generators. Hydrogen generators offer temporary and high-powered outputs, which IDTechEx believes offers strong value propositions to the growing numbers of electric construction vehicles.

As net-zero targets get stricter and the push for electrification grows, infrastructure is expected to be required much quicker than the grid can be built out. In this context, off-grid charging presents itself as a strong candidate for supplying this power without having to resort to carbon-intensive diesel generators. Many startups and incumbent OEMs are part of the landscape within off-grid charging. Noteable incumbent examples include Toyota, Hitachi, and GM with their hydrogen fuel-cell generators now being repurposed as stationery energy generation units.

IDTechEx says it has the most comprehensive EV charging research portfolio spanning major technologies like traditional conductive charging, wireless charging, battery swapping, and off-grid charging encompassing all vehicle segments already being electrified.